Articles

The Federal Solar Tax Credit Is Ending — What West Virginia Homeowners Need to Know

What Is the Federal Solar Tax Credit?

The Federal Solar Investment Tax Credit (ITC) has been one of the most powerful incentives driving solar adoption across the United States — including here in West Virginia.

When Does the Federal Solar Tax Credit Expire?

Under current federal law, the 30% residential solar tax credit expires at the end of 2025.

That means:

- Your solar system must be installed and placed in service by December 31, 2025

- To claim the credit, the system must be operational — not just under contract

- After this date, homeowner-owned solar systems will no longer qualify for the 30% credit

This creates a clear and immovable deadline for homeowners considering solar.

How Much Is the Solar Tax Credit Worth?

The value of the federal solar tax credit depends on the size of your system.

For example:

- A $20,000 solar system → $6,000 tax credit

- A $30,000 solar system → $9,000 tax credit

That credit directly reduces what you owe in federal income taxes. If you don’t use it all in one year, it can typically be carried forward.

When the credit disappears, those savings disappear with it.

For homeowners, the ITC has allowed you to:

- Claim 30% of the total cost of a solar system as a federal tax credit

- Reduce your out-of-pocket cost by thousands of dollars

- Improve the overall return on investment of going solar

For many families, this credit is the difference between thinking about solar and actually moving forward.

What About Businesses and Commercial Solar Projects?

While the residential credit is ending, there is limited runway left for commercial projects.

Businesses may still qualify if:

- Construction begins by July 4, 2026

- A qualifying portion of the project (often 5–10%) is completed under IRS “safe harbor” rules

Commercial projects may also qualify for:

- The 30% base ITC

- Potential bonus credits, bringing total incentives higher in some cases

This means commercial solar still has life, but residential homeowners face the most immediate deadline.

Why This Deadline Matters for West Virginia Homeowners

When combined with:

- Rising electric rates

- Net metering changes coming in 2026

- Increasing demand for solar installation capacity

The expiration of the federal solar tax credit creates a time-sensitive decision window.

Waiting too long could mean:

- Missing the 30% tax credit entirely

- Facing longer installation timelines

- Losing thousands in potential savings

This is why many homeowners are choosing to act sooner rather than later.

What If I Don’t Owe Enough in Taxes?

This is a common question — and an important one.

If the federal tax credit isn’t a good fit, homeowners still have options:

- Financing programs that reduce upfront cost

- Lease and third-party owned solar options, where incentives are captured by the provider and reflected in lower energy rates

Solar is no longer one-size-fits-all — the right structure depends on your financial situation and goals.

Why 2025 Is a Critical Year for Solar

Between the ending tax credit and net metering changes, 2025 represents a unique overlap of incentives that won’t last.

If solar has been on your radar:

- This is the year to evaluate it seriously

- This is the year incentives are at their strongest

- This is the year timing works in your favor

Talk to a West Virginia Solar Expert Before the Credit Ends

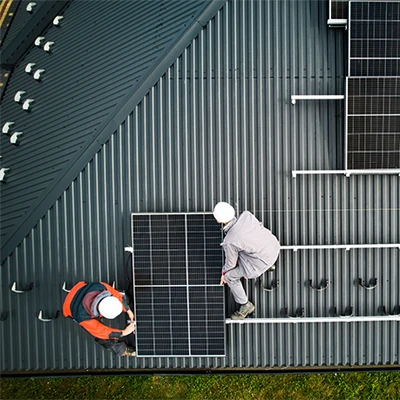

At Revolt Energy, we help homeowners:

- Understand how the federal solar tax credit applies to them

- Design systems that meet deadline requirements

- Explore ownership, financing, and lease options

If you’re considering solar, don’t wait until the incentive is gone to find out what you missed.

Schedule a free solar consultation with Revolt Energy today